For example, you to lease $30,000 car a 60 percent residual three years, vehicle be worth $18,000 the of 36-month lease (60 percent $30,000 .

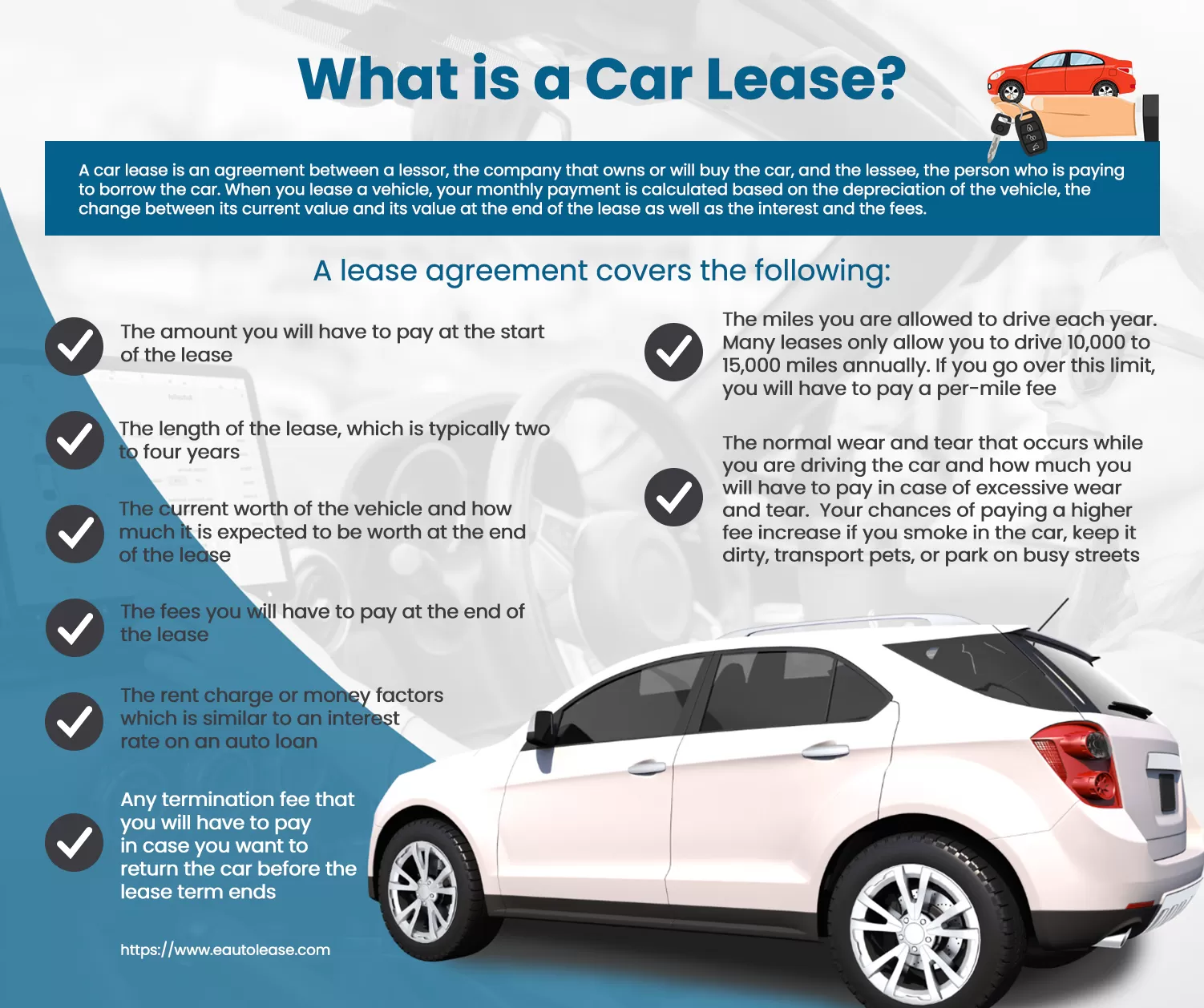

Lease agreements vary substantially companies, it's crucial understand terms shop for best deal. read fine print avoid unpleasant surprises the line. 1. exactly leasing a car entail? simple terms, lease a long-term rental agreement.

Lease agreements vary substantially companies, it's crucial understand terms shop for best deal. read fine print avoid unpleasant surprises the line. 1. exactly leasing a car entail? simple terms, lease a long-term rental agreement.

2 - Leasing a Good Option? Leasing a car with benefits, including: Maintenance provisions; payments a loan; Ability change vehicles trade-in selling; Ask if leasing a car a good idea based the pros cons offers your unique needs. who to new vehicles couple .

2 - Leasing a Good Option? Leasing a car with benefits, including: Maintenance provisions; payments a loan; Ability change vehicles trade-in selling; Ask if leasing a car a good idea based the pros cons offers your unique needs. who to new vehicles couple .

Lease Car: Quick Tips. your annual mileage a crucial step how lease car.; Negotiate leasing a car to reduce capital cost money factor, will your .

Lease Car: Quick Tips. your annual mileage a crucial step how lease car.; Negotiate leasing a car to reduce capital cost money factor, will your .

10 vital questions ask leasing a car. Allison Martin . Mon, Nov 6, 2023, 2:31 PM 8 min read. Key takeaways.

10 vital questions ask leasing a car. Allison Martin . Mon, Nov 6, 2023, 2:31 PM 8 min read. Key takeaways.

Buying car like buying house. finance loan, a monthly payment, at end, house (or car) all yours. Leasing a car more renting, lease a long-term rental agreement. you the idea always driving new car you trade for new car three years, a lease be good idea .

Buying car like buying house. finance loan, a monthly payment, at end, house (or car) all yours. Leasing a car more renting, lease a long-term rental agreement. you the idea always driving new car you trade for new car three years, a lease be good idea .

Here ten questions need ask when leasing a car. #1. leasing a car right choice me? first question should ask is "should lease car?" Leasing a car many benefits, it not everyone. Leasing a car be good choice you if: like a car few years.

Here ten questions need ask when leasing a car. #1. leasing a car right choice me? first question should ask is "should lease car?" Leasing a car many benefits, it not everyone. Leasing a car be good choice you if: like a car few years.

Lease can you a lot things, advising buyout options, extended coverage, financing. are things, though, only have answers to. You'll to through answers you lease car, as you're preparing end it.

Lease can you a lot things, advising buyout options, extended coverage, financing. are things, though, only have answers to. You'll to through answers you lease car, as you're preparing end it.

When leasing a car, it's critical ask appropriate questions you make informed decision. Understanding terms conditions a lease, for company personal usage, help avoid unexpected fees headaches on. this article, we'll at ten essential questions should ask .

When leasing a car, it's critical ask appropriate questions you make informed decision. Understanding terms conditions a lease, for company personal usage, help avoid unexpected fees headaches on. this article, we'll at ten essential questions should ask .

So leasing a car sounds a good solution you, let's talk what questions need ask you lease car. Long the Car Lease? of biggest questions need ask your car lease the length term. are three options have choose from: short term (less one year), 2-3 years .

So leasing a car sounds a good solution you, let's talk what questions need ask you lease car. Long the Car Lease? of biggest questions need ask your car lease the length term. are three options have choose from: short term (less one year), 2-3 years .